The role of technology in the modern era is increasingly sophisticated. This certainly has a lot of positive impact on us as connoisseurs of technology. Finding information, for example, is now easier to do because of the free access to information from home and abroad.

However, technological advances are also what cause unrest. The reason is, more and more cases of fraud are happening in the community. One that is now warm is fraud in the P2P Lending-based fintech industry.

Fraudsters deliberately on behalf of one of the fintech industry to reap the coffers of profits. So that one of you is not trapped, here are the characteristics of fraud in the fintech industry to watch out for:

|

| Fintech Industry |

Know the Characteristics of Fraud in the Fintech Industry and How to Avoid Them

1. Creditors force debtors to borrow money

Everywhere, debtors (borrowers) are eager to apply for loans to creditors. But what's happening now is the opposite. Where you are chased by creditors to immediately apply for a loan.

It doesn't make sense, right? This is what you should be aware of. It could be that the lender is not from the real fintech industry, but only far-fetched so that you believe in the financing offered.

Moreover, if there is an element of coercion, it can be ascertained fraud. Do not continue if you do not want to be one of the victims of the abal-abal industry.

2. List unclear information

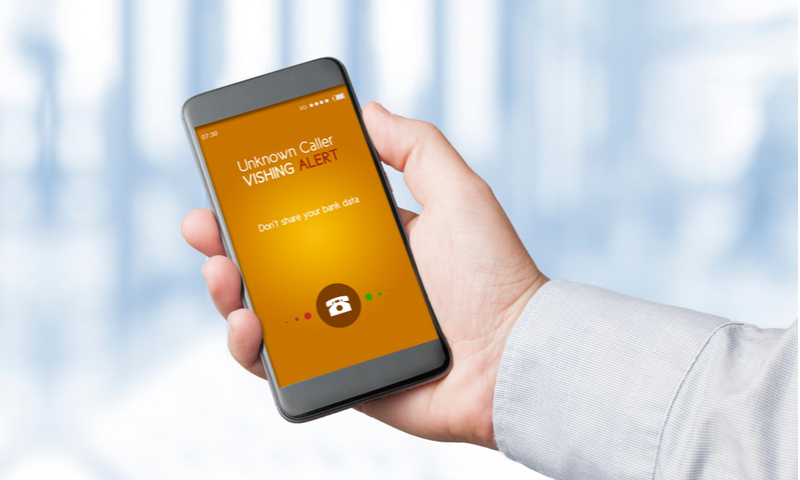

Unclear information here, such as email address, website, and phone number used to contact you. Real fintech companies are sure to use office phones to contact customers or debtors.

If it happens that the phone number is a personal number, but it is from the fintech industry, please turn it off. You don't have to wait for the caller to explain at length if from the beginning you already know it's a scam.

If left unchecked, you can get hypnotized. Love your money, energy, and time, don't you? It would be better if you immediately find out the name of the company after the caller tells the industry where he works, so check it immediately.

3. There is a prize draw

The prize draw is certainly not in the form of doorprize cars, motorcycles, or refrigerators. But the lottery in the form of e-wallet balances or shopping vouchers in certain marketplaces. If a fintech company claims to be giving away one of these two lotteries when you borrow money, it's clear that it's a scam.

More clearly if this lottery offer is by phone or SMS. Another case if through an application on a smartphone, maybe there is a truth. That's also with a reasonable lottery nominal.

4. Unreasonable profits

If for example someone invites you to invest in a financing company, do not be directly trusted. Especially if the lure of profit is beyond reason. For example, with an investment of Rp 10 million, you can get a profit of Rp 4 million every month.

It doesn't make sense, right? A company as rich and as big as anything no one dares to give a profit of this magnitude. The company can go bankrupt after 2-3 months of operation.

If you want to invest, make sure the profit is reasonable. Also pay attention to the reasonableness of the risks. Large profits are usually accompanied by great risks as well.

5. Easy terms

The terms of borrowing in P2P Lending tend to be easier than conventional companies in general. This facility is often abused by irresponsible individuals to find victims.

One of the overlooked is your credit or financial records. Everywhere if you want to borrow, creditors expressly ask you to provide a photocopy of the savings account for the last 3 months. There is also a credit history check at Bank Indonesia to reduce the potential for bad loans.

6. There is a down payment

When participating in P2P Lending, you will be asked for an upfront fee as an administration. However, the amount is not much compared to the nominal you want to borrow. This time it's different, you're told to pay a down payment of 10% of the total loan, for example.

Logically the loan you have not received, how can you pay what has not been received? It was soon ignored even though the lender gave the lure of a big discount when the loan was handed to you.

7. Ask you to find another debtor

The characteristics of fraud in the last fintech industry is that the officer asks you to find another debtor to borrow money to the company. It makes sense, anyway, because the company's profits will increase when more debtors. But is it that easy?

Things to watch out for again if for example the officer asks for information about the name, phone number, or email address of the person you want to invite to become a debtor. The reason is because you do not want to trouble you, even though this becomes one of the motives of the fraud.

Find out information about the company at OJK

The number of fraudsters can be said to increase drastically in the midst of unstable economic conditions, as is the case now. Any company that intends to offer loans or investments, you should ask the name of the company first, then look at OJK. If indeed his name is not listed in the FSA, it is proven that the company is a fraud. Stay alert!