When to Change Your Investment Strategy — A Complete Guide (SEO-Optimized & Expert-Backed)

Last updated: January 2026

In the constantly shifting world of finance, knowing when to change your investment strategy isn’t just a smart move — it’s essential. Investors who fail to adapt risk stagnation or loss, while those who adjust at the right time position themselves for long-term success.

In this comprehensive, Google EEAT-friendly article, you’ll learn:

The key signals that indicate you should rework your strategy

How market cycles and life changes affect your investment choices

A practical checklist for reviewing your portfolio

Links to related expert articles and tools to help you make better decisions

📌 What Is an Investment Strategy?

An investment strategy is a plan that guides your decisions on where, when, and how much to invest. Whether you prefer stocks, real estate, bonds, or alternative assets, the goal is to balance risk and reward according to your objectives and timeline.

As markets evolve and personal circumstances change, even proven strategies can become outdated — making timing crucial.

(Related: How to Build a Smart Investment Plan in 2026)

🧠 Why Timing Matters in Investment Decisions

Investing isn’t “set it and forget it.” Markets are dynamic, influenced by economic growth, inflation, interest rates, geopolitics, and investor sentiment. A strategy that worked in a low-interest, high-growth market may falter when conditions shift.

Core Reasons You Might Need to Adjust Your Strategy:

Major Market Shifts — Bear markets, inflation surges, or sector rotation

Life Events — Retirement, marriage, inheritance, or job changes

New Financial Goals — Saving for a home vs. college tuition

Performance Issues — Underperforming assets compared to benchmarks

Risk Tolerance Changes — E.g., reducing risk as retirement nears

Learn more about aligning goals and risk in this internal guide to risk management.

✨ Signals It’s Time to Rebalance or Revise

Here are practical signs that suggest it’s time for a strategy shift:

🔹 1. Your Portfolio Drifts From Target Allocation

If stocks, bonds, or other assets swing too far from your intended ratios, your risk profile may change. This imbalance can expose you to more volatility than intended.

🔹 2. You’re Not Meeting Performance Benchmarks

Consistent underperformance against relevant benchmarks (e.g., S&P 500, global bond indices) deserves investigation. It might signal ineffective asset choices or outdated assumptions.

🔹 3. Economic Trends Shift (e.g., Rising Rates)

Monetary policy changes — like interest rate hikes — can make fixed-income less attractive and shake up equities valuations. Awareness matters.

👉 For real-time macroeconomic insights, consider reading external reports like the World Bank’s Global Economic Prospects:

🔗 https://www.worldbank.org/en/publication/global-economic-prospects

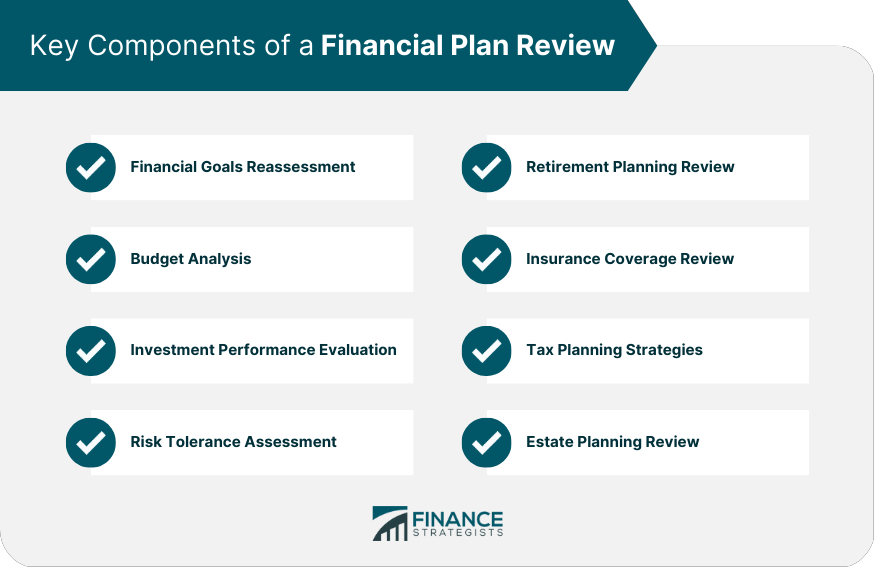

🧩 How to Perform an Annual Investment Strategy Review

A yearly review helps you stay aligned with goals and market realities. Here’s a step-by-step method:

✅ Step 1: Re-evaluate Your Goals

Ask:

Are my goals the same?

Has my timeline changed?

Do I need more liquidity?

✅ Step 2: Reassess Your Risk Tolerance

Life stressors, aging, or career changes may affect how much risk you’re comfortable with.

Tip: Younger investors can often tolerate more risk due to a longer time horizon.

✅ Step 3: Check Asset Performance

Compare your assets against industry benchmarks and decide what to keep, increase, or trim.

✅ Step 4: Review Costs & Fees

High fees can erode returns — especially in actively managed funds.

📉 When Not to Change Your Strategy

While rebalancing is important, overtrading based on short-term news can harm long-term performance. Avoid changes based on emotion or panic.

Instead:

Stick to a disciplined plan

Make adjustments based on data, not headlines

💡 For guidance on disciplined strategies, see Why Long-Term Investing Beats Trading Every Time.

📊 Case Studies: Real-World Strategy Adjustments

⭐ Case 1: Market Downturn Leads to Diversification

An investor heavily weighted in tech stocks sees market volatility and expands into bonds and international equities — reducing risk and smoothing returns.

⭐ Case 2: Life Stage Shift Requires Lower Risk

Approaching retirement, a 50-year-old downsizes equities and increases fixed-income holdings to preserve capital.

These examples highlight how context matters when making strategic shifts.

🌐 External Resources for Smart Investing

For deeper insights from trusted financial institutions:

🔗 Morningstar – Investment Research & Ratings: https://www.morningstar.com/

🔗 Investopedia – Beginner to Advanced Guides: https://www.investopedia.com/

🔗 World Bank – Economic Forecasts & Trends: https://www.worldbank.org/

These sites provide expert explanations, data analysis, and educational content to strengthen your financial decisions.

🏆 Final Thoughts: Adapt but Don’t Overreact

Successful investing means:

Monitoring performance

Adapting to life and market changes

Avoiding knee-jerk reactions

Changing your investment strategy isn’t a sign of failure — it’s a mark of financial maturity and awareness.

Keep learning, stay disciplined, and revisit your plan with a clear head.

Ready to go deeper? Don’t miss our related articles:

👉 Top 10 Investment Mistakes to Avoid in 2026

👉 Understanding Asset Allocation for Beginners