Dividend vs Growth: Smart Financial Sector Investment Tips in the USA

Unlock the keys to successful investing with a comprehensive guide tailored for US investors — complete with expert insights, comparison tables, risk tips, and actionable calls-to-action.

Introduction

Investing in the financial sector remains one of the most enduring strategies for building wealth in the USA. Whether you're seeking regular income through dividends or long-term capital appreciation through growth, understanding the nuances between dividend investing and growth investing is crucial. This article will guide you through the differences, pros and cons, and how to choose the best approach based on your financial goals.

We’ll also include official resources from trusted institutions like the U.S. Securities and Exchange Commission (SEC), Federal Reserve, and Internal Revenue Service (IRS) to support your research and decision-making.

What Is Dividend Investing?

Dividend investing centers on buying stocks that regularly distribute a portion of earnings back to shareholders in the form of cash dividends.

👉 Example: Many established financial companies such as banks and insurance firms pay quarterly dividends to reward long-term investors.

Key Benefits

Income Generation: Steady cash flows from dividends.

Lower Volatility: Dividend-paying stocks can be less volatile.

Reinvestment Power: Dividend Reinvestment Plans (DRIPs) accelerate compounding.

👉 Visit the SEC’s investor education page to learn more about dividends and shareholder rights: https://www.sec.gov/investor/pubs/investorpubs.htm

What Is Growth Investing?

Growth investing emphasizes companies expected to grow earnings faster than the overall market, often reinvesting profits instead of paying dividends.

Key Benefits

Capital Appreciation: Value increases as company earnings expand.

Tax Efficiency: No dividend tax until you sell the stock.

Innovative Potential: Often involves companies with transformational technologies or business models.

👉 For growth investing fundamentals, see the Investing Basics guide from FINRA: https://www.finra.org/investors/learn-to-invest

Dividend vs Growth: Comparison Table

| Feature | Dividend Investing | Growth Investing |

|---|---|---|

| Primary Goal | Income generation | Capital appreciation |

| Best for | Retirees, income-focused investors | Long-term wealth builders |

| Volatility | Lower | Higher |

| Tax Implications | Dividend taxes may apply | Capital gains tax upon sale |

| Typical Sectors | Financials, Utilities, Consumer Staples | Tech, Healthcare, Innovation |

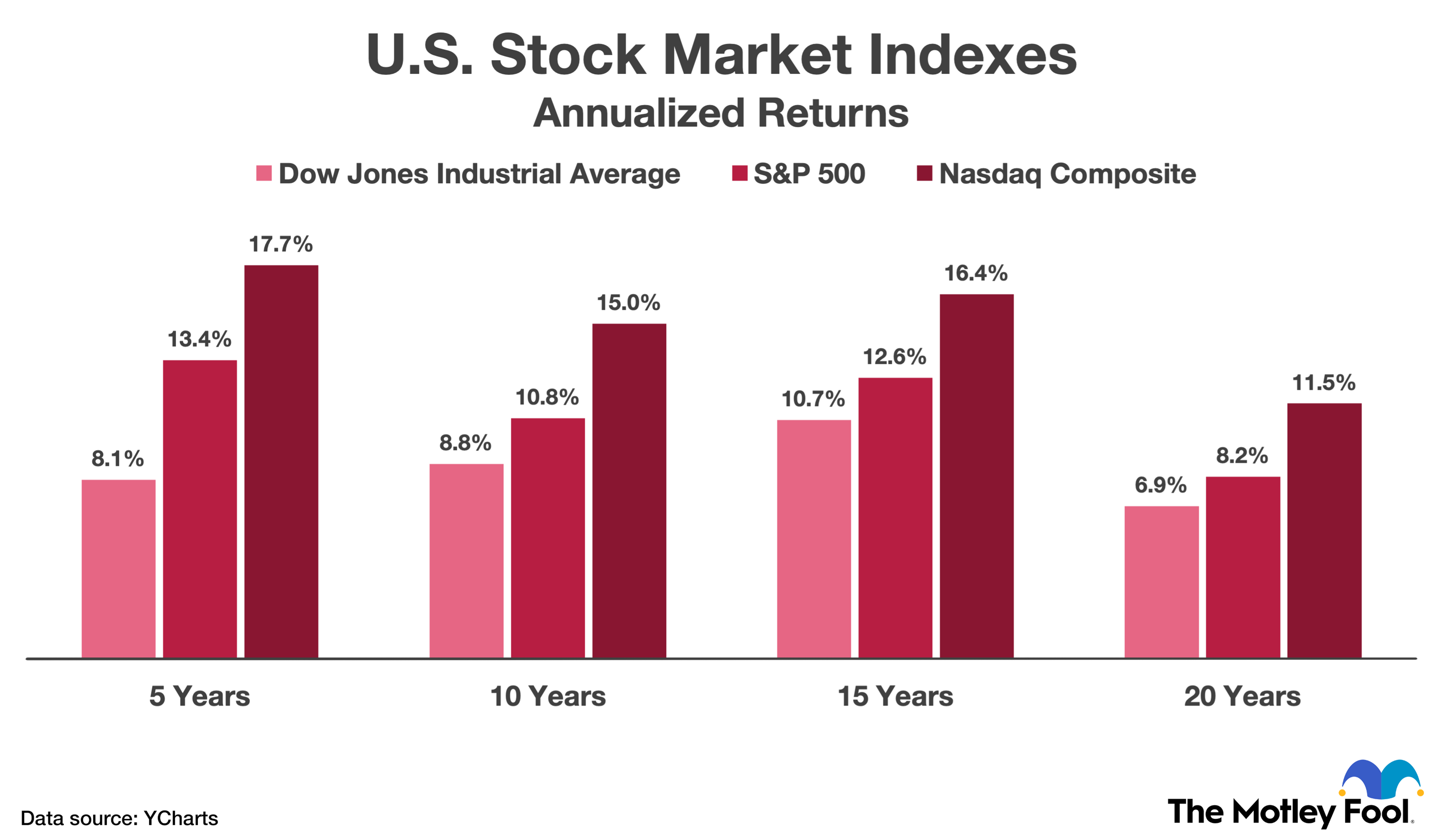

| Example Indexes | S&P 500 Dividend Aristocrats | NASDAQ Composite |

Dividend stocks are especially common among:

Major banks

Insurance companies

REITs (Real Estate Investment Trusts)

👉 Explore dividend-focused ETFs like Vanguard Dividend Appreciation ETF (VIG) or Schwab U.S. Dividend Equity ETF (SCHD) — both known for strong yield and quality selection.

Growth Stocks in the Financial Sector

Growth opportunities exist in:

FinTech companies

Digital banks

Data-enabled financial services

These companies might not pay dividends but reinvest earnings to scale operations quickly.

👉 Research growth-oriented financial stocks via reputable research providers such as Morningstar and Yahoo Finance.

Which Is Right for You?

Choosing between dividend and growth investing ultimately depends on your goals:

Ask Yourself:

Do you need current income or long-term growth?

What is your risk tolerance?

Are you investing for retirement, education, or wealth accumulation?

How important are tax considerations?

💡 Many investors adopt a hybrid strategy — owning both dividend champions and growth potential stocks for diversification and balance.

Checklist Before You Invest

✔ Understand the company’s fundamentals

✔ Review historical dividend coverage and stability

✔ Analyze growth trajectory and earnings projections

✔ Check valuation multiples and industry dynamics

👉 Use the Federal Reserve’s data tools for economic indicators relevant to the financial sector: https://www.federalreserve.gov/economic-research.htm

Risk Disclaimer

Investing involves risks, including possible loss of principal. Past performance is not indicative of future results. This article is for educational purposes only and does not constitute financial advice. Always consult a licensed financial advisor before making investment decisions.

Calls to Action

📌 Compare investment platforms — Evaluate brokers that offer both dividend and growth investing tools, research, and low fees.

📌 Check current rates — Monitor dividend yields and interest rates for financial sector investments regularly.

Author Bio

Azka – Financial Enthusiast

Azka is a passionate financial content creator focused on helping investors understand market strategies, asset allocation, and sector-based investing. Azka’s goal is to empower readers with actionable tips and reliable resources to achieve long-term financial success.