UnitedHealth Group vs CVS Health Stock: Healthcare & Insurance Giants Compared

Investors seeking exposure to the large and growing U.S. healthcare and health insurance industry face two of the sector’s biggest names: UnitedHealth Group (NYSE: UNH) and CVS Health (NYSE: CVS). Both companies offer insurance products and services integral to healthcare delivery, but their scale, business models, financials, and stock performance differ in meaningful ways.

This deep dive pits UnitedHealth Group vs CVS Health across key financial, strategic, and risk dimensions — essential reading for informed investment decisions and monetization-ready content.

📌 Executive Summary

| Feature | UnitedHealth Group (UNH) | CVS Health (CVS) |

|---|---|---|

| Industry | Health insurance, healthcare services | Retail pharmacy, insurance (Aetna) |

| Market Cap | Larger scale, diversified | Mid-sized, diversified |

| Revenue Growth | Strong, driven by Optum | Solid, plus pharmacy business |

| Operating Margin | Higher | Lower than UNH |

| Debt Profile | Lower risk | Higher leverage |

| Valuation | Premium pricing | More value-oriented |

| Dividend Yield | Moderate | Higher yield |

Data sources and financial patterns are based on recent comparative analyses. (Forbes)

📍 What UnitedHealth Group Does

UnitedHealth Group Inc. is a diversified healthcare giant that operates through two core businesses:

UnitedHealthcare – Health insurance products covering commercial and government plans.

Optum – Healthcare delivery, data analytics, technology, and pharmacy benefit management.

According to its corporate profile, UNH reported ~$400 billion in revenue in 2024, reflecting consistent growth. (Wikipedia)

👉 Official source: UnitedHealth Group corporate overview → https://www.unitedhealthgroup.com

CVS Health combines its pharmacy retail and pharmacy benefit management operations with health insurance services after acquiring Aetna in 2018. Its integrated model includes:

Retail pharmacies (CVS Pharmacy)

Health insurance and benefits (Aetna)

Pharmacy benefit management (Caremark)

As recent earnings showed, CVS’s insurance and pharmacy segments continue to drive performance, despite rising medical costs that are pressuring margins. (The Wall Street Journal)

👉 Official source: Investor relations at CVS Health → https://investors.cvshealth.com

📊 Side-by-Side Financial Comparison

| Metric | UnitedHealth Group | CVS Health |

|---|---|---|

| Revenue (2024 est.) | ~400B | ~372B |

| Net Income | Higher | Lower |

| Operating Margin | Stronger | Thinner |

| Debt-to-Equity | Lower | Higher |

| Cash Reserve | Larger percentages | Smaller percentages |

| Dividend Yield | ~1.6% | ~5.9% |

| (See source detailed evaluations.) (Artificall) |

UNH’s stronger margins and larger cash reserves reflect consistent profitability and financial discipline. CVS’s weaker margin profile is offset by its attractive dividend yield and stock valuation multiples. (Artificall)

📈 Stock Fundamentals Comparison

| Category | UNH (UnitedHealth) | CVS (CVS Health) |

|---|---|---|

| P/E Ratio | Higher | Lower |

| Price Performance | Variable, cyclical | Stronger recent relative gains |

| Growth Potential | Driven by Optum expansion | Balanced by retail + insurance |

| Risk Profile | Modest debt | Higher leverage |

| (Sources: Nasdaq, Forbes) (Forbes) |

💡 Key Highlight

UNH has demonstrated better revenue and profitability growth, while CVS trades at lower valuation multiples, making it potentially more attractive for value investors. (Forbes)

📊 On February 11, 2026, both UNH and CVS stocks rose as part of broader industry movement. (MarketWatch)

📈 CVS recently reported improving profit and revenue growth, beating forecasts and raising outlook — even amid industry turbulence. (The Wall Street Journal)

📦 Retail & Investment Product Examples for USA Audience

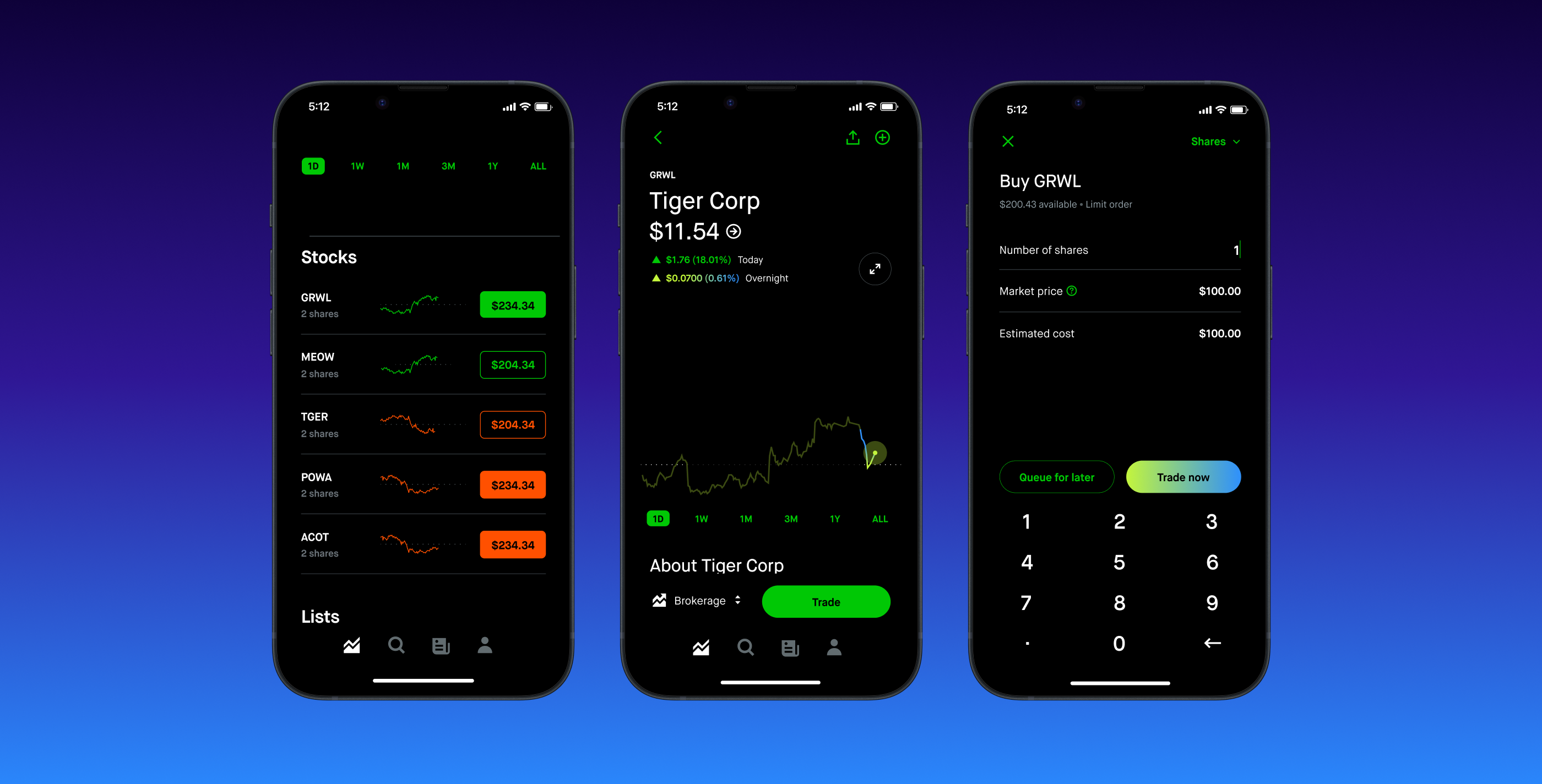

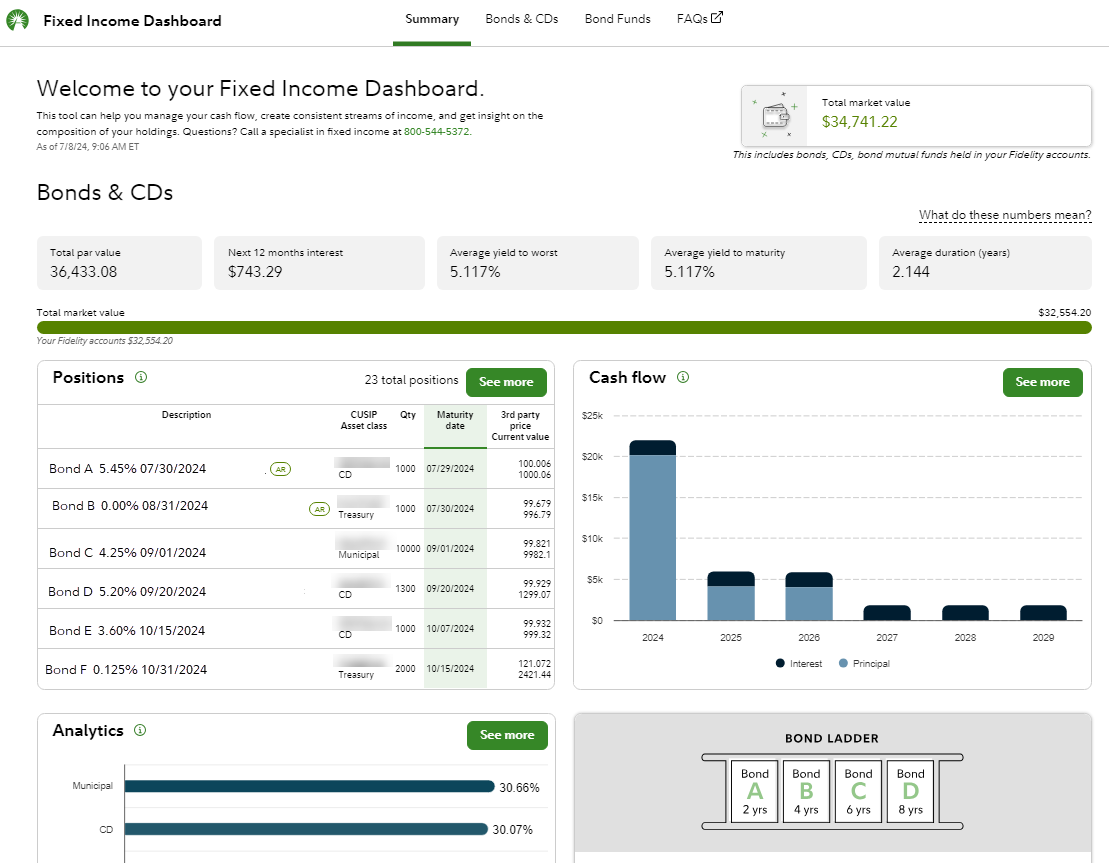

Below is a visual example of investment tools and brokerage products U.S. investors might consider when trading UNH and CVS stock:

Images above show popular U.S. investment platforms for buying stocks like UNH and CVS.

🧠 Which Is Right for You?

Here’s how to think about choosing between UNH and CVS as part of your portfolio:

🔹 UnitedHealth Group

✔ Better profitability and financial cushion

✔ Diversified healthcare services business

✔ Potential resilience in economic downturns

Best for: Investors prioritizing long-term stability and quality fundamentals

🔹 CVS Health

✔ Lower valuation metrics

✔ Higher dividend yield

✔ Exposure to retail & pharmacy demand

Best for: Investors seeking income and value tilt

📌 Your personal financial goals, risk tolerance, and time horizon matter most.

⚠️ Risk Disclaimer

Investing in stocks involves substantial risk of loss. Past performance does not guarantee future results. Stock prices can fluctuate widely due to market conditions, regulatory changes, and macroeconomic shifts. You should consult with a licensed financial advisor before making investment decisions.

The content provided in this article is for educational and informational purposes only and should not be construed as investment advice.

📎 Must-Read Official Sources

UnitedHealth Group official corporate site → https://www.unitedhealthgroup.com

CVS Health investor relations → https://investors.cvshealth.com

U.S. Securities and Exchange Commission (SEC) filings for UNH & CVS → https://www.sec.gov

These authoritative links help verify financial reports and filings directly from the source.

🚀 Call to Action

📊 Ready to explore investment choices?

👉 Compare investment platforms and find the best brokerage for your stock strategy.

👉 Check current rates and real-time pricing for UNH and CVS shares to inform your next move.

✍️ Author Bio

Azka – Financial Enthusiast

Azka is a passionate finance writer focused on stocks, investment strategy, and market trends. With a keen interest in U.S. equities and personal finance, Azka delivers practical insights and data-driven analysis to help readers make smarter investing decisions.