401(k) vs IRA: Which Retirement Account Is Better? (2026 Guide)

This comprehensive guide dives deep into the differences, benefits, limitations, and real-world use cases of 401(k) plans and IRAs—helping you decide which one fits your financial situation best in 2026 and beyond.

📌 What Is a 401(k)?

A 401(k) is an employer-sponsored retirement plan that allows employees to save a portion of their paycheck on a pre-tax basis (traditional 401(k)) or after-tax basis (Roth 401(k)). These contributions grow tax-deferred (or tax-free for Roth), and many employers also offer matching contributions—essentially free money toward your retirement.

💡 IRS official info on 401(k) plans:

✔️ See IRS Retirement Plans FAQs ➝ https://www.irs.gov/retirement-plans/retirement-plans-faq-regarding-401k-plans

📌 What Is an IRA?

An Individual Retirement Account (IRA) is a personal retirement savings account you open on your own outside of employer sponsorship. There are two main types:

Traditional IRA – Contributions may be tax-deductible; taxes owed at withdrawal.

Roth IRA – Contributions after tax, but qualified withdrawals (including earnings) are tax-free.

💡 IRS official info on IRAs:

✔️ IRA contribution rules & limits ➝ https://www.irs.gov/retirement-plans/ira-contribution-limits

According to the Internal Revenue Service (IRS) and retirement experts:

401(k) Contribution Limits (2026)

Base limit: $24,500

Catch-up contribution (age 50+): + $8,000

Special “super catch-up” for ages 60–63: $11,250

Employer contributions and your personal contributions combined can reach higher totals. (Fidelity)

IRA Contribution Limits (2026)

Base limit: $7,500

Catch-up (50+): + $1,100

Eligibility to contribute to a Roth IRA depends on income levels ➝ check IRS guidelines. (Kiplinger)

📊 401(k) vs IRA — Side-by-Side Comparison

| Feature | 401(k) | IRA |

|---|---|---|

| Offered by Employer? | Yes | No |

| Annual Contribution Limit (2026) | $24,500 (+ catch-ups) | $7,500 (+ catch-up) |

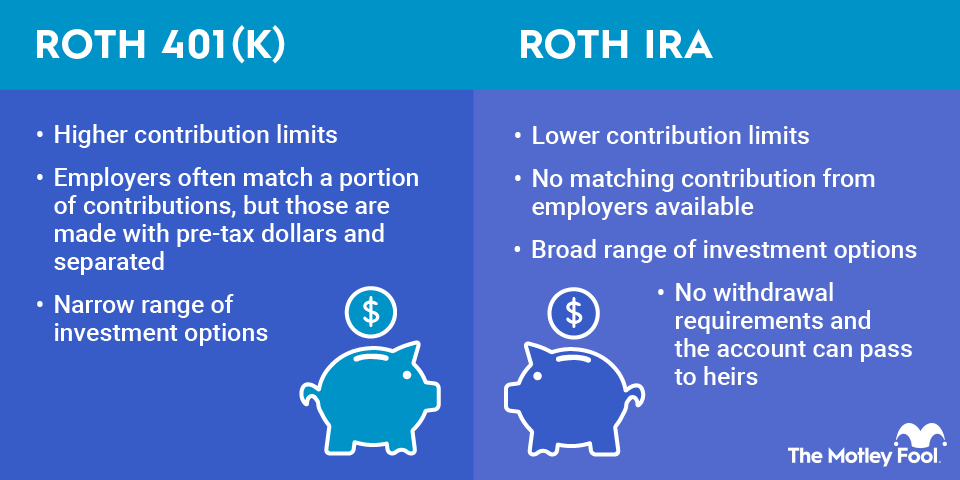

| Roth Option Available? | Yes (Roth 401(k)) | Yes (Roth IRA) |

| Employer Matching | Often yes | No |

| Income Limits for Contributions | None | Roth IRA phases out at certain income thresholds |

| Investment Choices | Limited by employer plan | Broader selection |

| Portability | May require rollover | Fully portable |

📌 401(k) vs IRA — Detailed Differences

🧾 Employer Match

One of the most significant advantages of a 401(k) is employer matching. Many companies match up to a certain percentage of your contributions, effectively boosting your savings. (Citi)

💰 Contribution Capacity

401(k)s allow much higher annual savings limits compared to IRAs—making them better for high-income savers or those who want to accelerate retirement funding. (Fidelity)

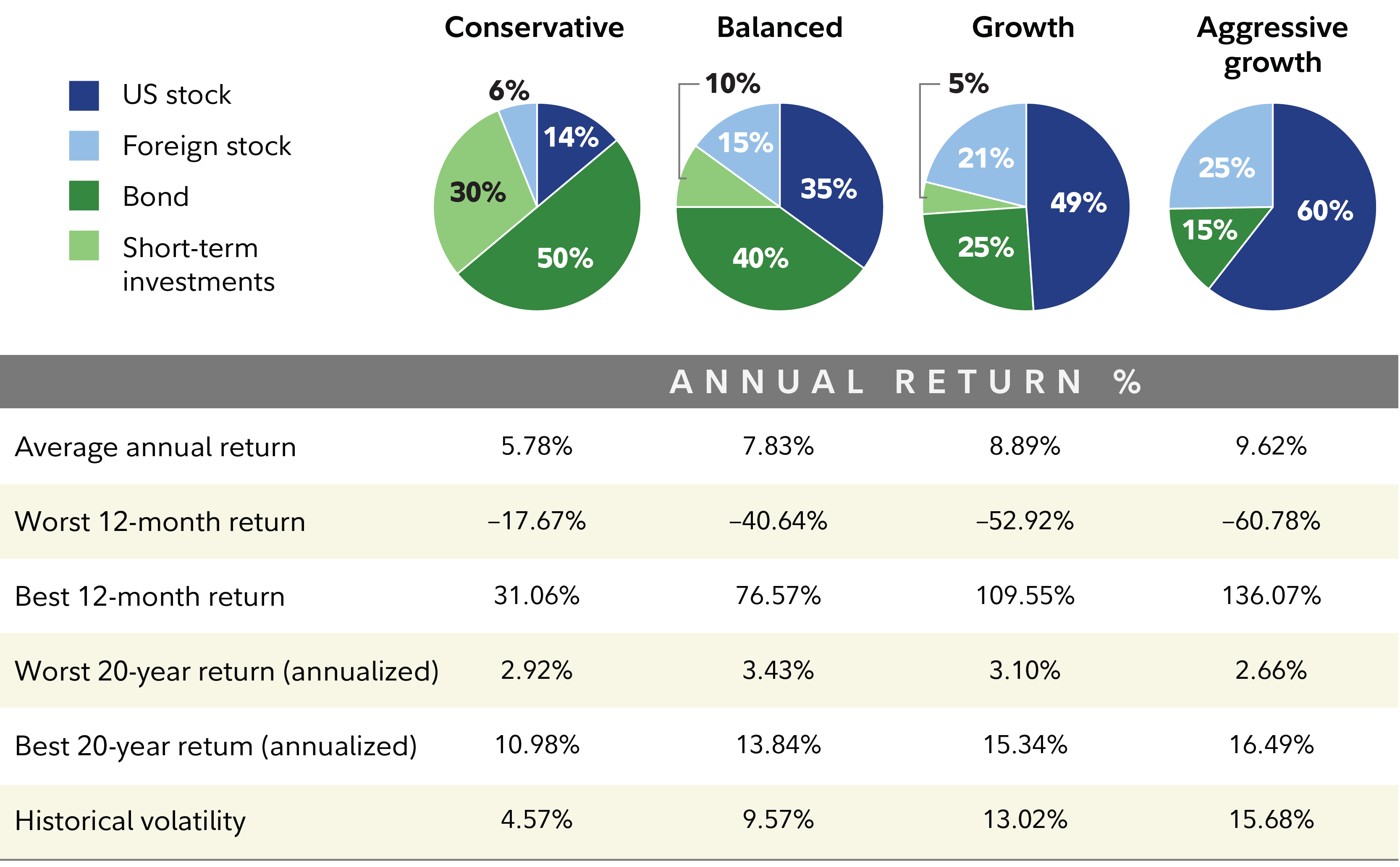

📈 Investment Control

IRAs offer a broader universe of investment options (stocks, bonds, ETFs), whereas 401(k) choices are often limited to select mutual funds or target-date funds chosen by the employer. (Encyclopedia Britannica)

🔁 Portability

If you change jobs, your 401(k) can be rolled over into an IRA, keeping tax benefits intact. This makes an IRA a flexible option if you plan to switch employers often. (SmartAsset)

👉 Which Is Right for You?

To help you decide, consider the following scenarios:

You Might Prefer a 401(k) If:

✔️ Your employer offers a strong match

✔️ You want to save as much as possible each year

✔️ You prefer automated paycheck deductions

You Might Prefer an IRA If:

✔️ You want full control over investment choices

✔️ You’re self-employed or not eligible for a 401(k)

✔️ Roth tax-free withdrawal benefits matter more

💡 In many cases, the best strategy is to contribute to your 401(k) up to the employer match and then use an IRA to diversify your tax strategy and investment flexibility.

📊 Case Studies – Real World Examples

Scenario A — Young Professional (Age 30)

Maxes 401(k) match

Contributes to Roth IRA for tax-free growth

Flexible investment choices with IRA

Scenario B — High Earner (Age 50+)

Maxes 401(k) contribution with catch-ups

Uses Traditional IRA for tax deduction

Considers Roth IRA conversion for future tax planning

⚠️ Risk Disclaimer

This article is for educational and informational purposes only and does not constitute financial, tax, or investment advice. Always consult a licensed financial advisor, tax professional, or official IRS publications for decisions based on your personal financial situation. Investments are subject to market risk, including the possible loss of principal.

🔗 Official & Trusted Resources

For IRS retirement guidelines and annual updates:

🔗 IRS Retirement Plans FAQs ➝ https://www.irs.gov/retirement-plans/retirement-plans-faq-regarding-401k-plans

🔗 IRS IRA Contribution Limits ➝ https://www.irs.gov/retirement-plans/ira-contribution-limits

🔗 IRS Publication 590-A & 590-B (Roth and Traditional IRA rules) ➝ https://www.irs.gov/forms-instructions

📈 Ready to Compare Options?

👉 Compare Investment Platforms — Find the best place to open your IRA or rollover your 401(k).

👉 Check Current Rates — See today’s retirement savings yields and platform fees.

📝 Author Bio

Azka — Financial Enthusiast

Azka is a personal finance writer focused on helping individuals make smarter retirement decisions. With deep experience in retirement planning, tax-advantaged investing, and financial literacy, Azka creates content that is clear, actionable, and focused on long-term wealth creation.