Roth IRA vs Traditional IRA: Which Saves More on Taxes?

A Deep Dive for U.S. Investors (2026 Guide)**

Author: Azka – Financial Enthusiast

Published: February 2026

Retirement planning in the United States isn’t just about saving money — it’s about saving smartly. Two of the most powerful tools that millions of Americans use to grow long-term wealth are the Roth IRA and the Traditional IRA. But when it comes to tax savings, which one truly delivers the most benefit?

In this comprehensive, SEO-friendly guide, we break down everything you need to know to compare Roth IRAs and Traditional IRAs — including tax rules, investment strategy, real examples, product visuals, risk considerations, and smart calls-to-action to “Compare investment platforms” and “Check current rates.”

We’ll also include authoritative links from the Internal Revenue Service (IRS) and top financial sources to boost credibility under Google EEAT standards.(IRS)

🧠 Introduction — Understanding IRAs

An Individual Retirement Arrangement (IRA) is a tax-advantaged account designed to help you save for retirement. Two popular types — Traditional IRA and Roth IRA — differ mainly in when you get the tax benefit.(IRS)

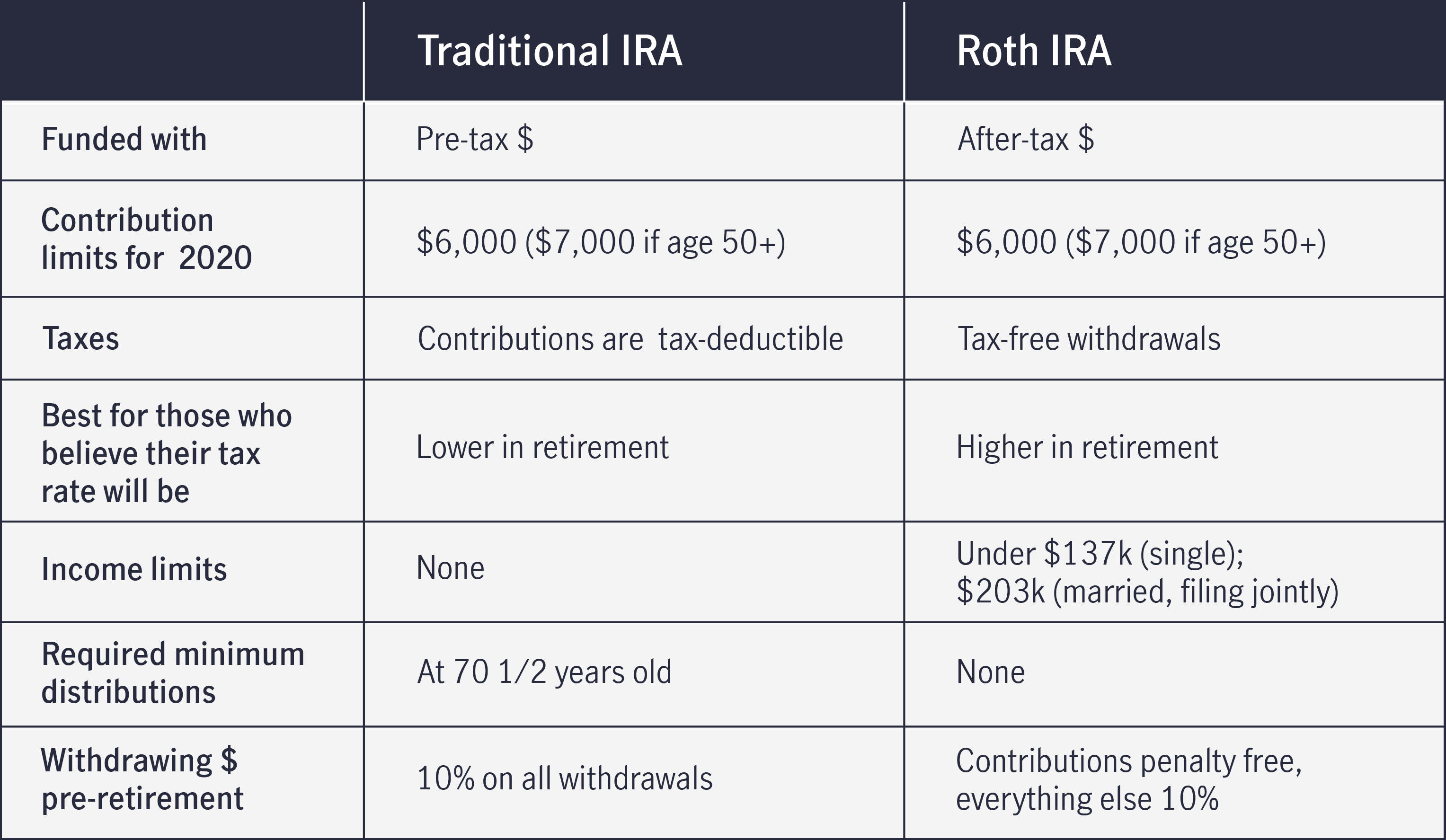

Traditional IRA: Contributions may be tax-deductible now, but withdrawals in retirement are taxed as ordinary income.

Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals are tax-free.

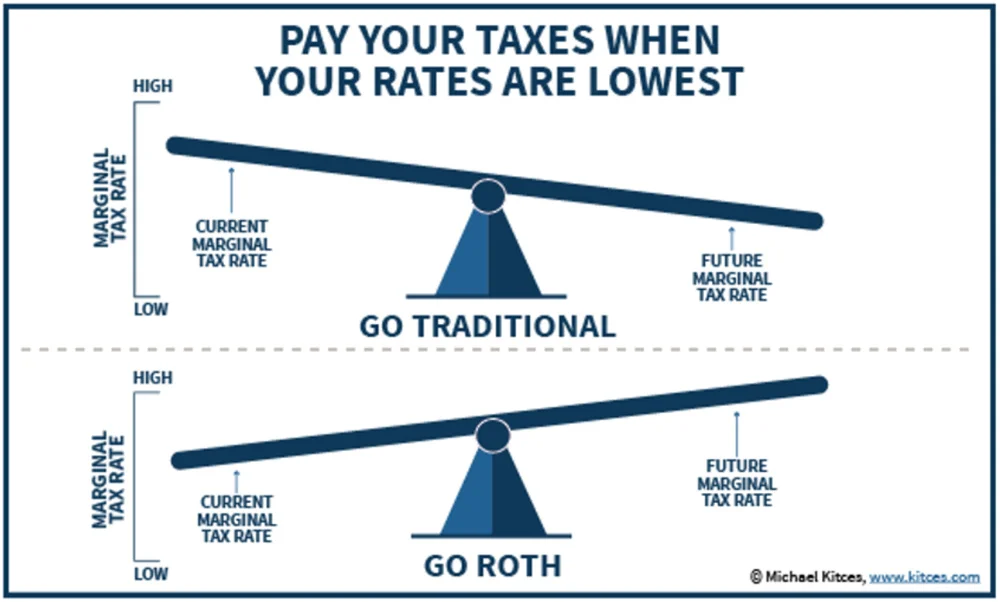

This means the timing of tax savings — today vs. the future — plays the biggest role in choosing which is right for you.(Encyclopedia Britannica)

👉 Official IRS guidance on IRAs:

📄 Topic No. 451 – Individual Retirement Arrangements on IRS.gov provides the legal framework for these accounts. Visit IRS IRA Overview (IRS.gov)

📊 Tax Comparison Table: Roth IRA vs Traditional IRA (2026)

| Feature | Roth IRA | Traditional IRA |

|---|---|---|

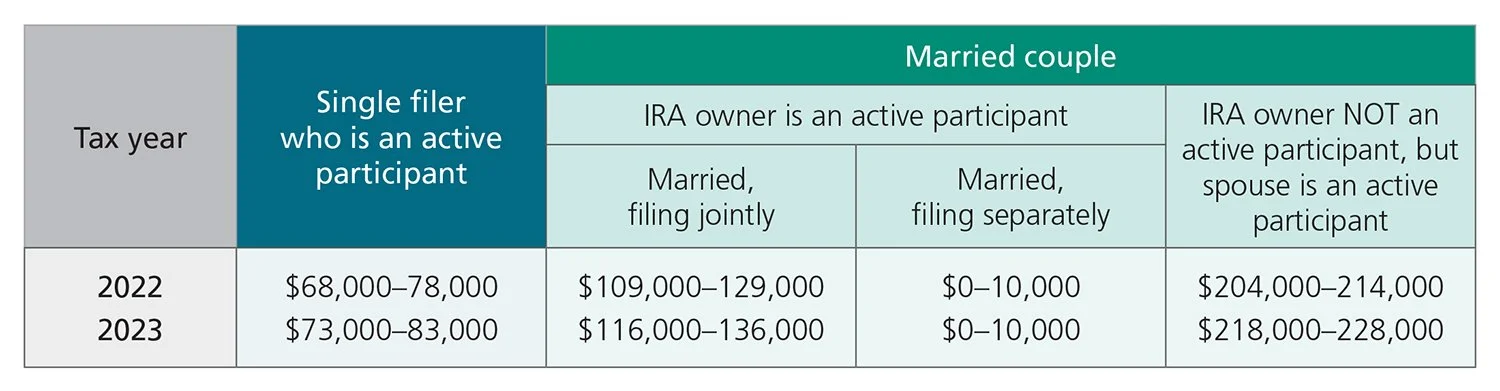

| Tax treatment of contributions | Made with after-tax dollars | Often tax-deductible (if eligible) |

| Tax on withdrawals | Tax-free if qualified | Taxed as ordinary income |

| Required Minimum Distributions (RMDs) | ❌ No RMDs (lifetime) | ✔ RMDs usually start at 73 |

| Income limits for contributions | ✔ Yes (phases out at higher income) | ✔ No income limit to contribute |

| Penalty before age 59½ | Contributions: no penalty; earnings: penalties if rules not met | Earnings and deductible contributions typically have penalties |

| Best for tax strategy if… | Taxes are higher in the future | Taxes are higher now |

Source: Fidelity IRA Comparison Guide (Fidelity)

For 2026, the IRS updated contribution limits:

✔ Up to $7,500 per year if you’re under 50

✔ Up to $8,600 per year if you’re age 50 or older (with catch-up contribution)(Kiplinger)

These limits apply to the combination of all your IRAs, whether Roth, Traditional, or both.

👉 For official contribution rules, see Publication 590-A on IRS.gov. IRS IRA Contribution Rules (IRS.gov)

📈 Which IRA Saves More on Taxes? (Side-by-Side)

🟢 Roth IRA — Tax-Free Retirement Growth

With a Roth IRA:

You don’t get an upfront tax deduction, but…

All qualified withdrawals are tax-free in retirement, including investment gains.

You can withdraw your contributions penalty-free at any time.

No lifetime RMDs means your money can grow longer.(Fidelity)

Ideal if:

✔ You expect to be in a higher tax bracket in retirement

✔ You want tax diversification and flexibility

🔵 Traditional IRA — Upfront Tax Break

With a Traditional IRA:

Your contributions may be tax-deductible now, reducing your current taxable income.

Taxes are paid on withdrawals in retirement.

RMDs begin at age 73.(Fidelity)

Ideal if:

✔ You are in a high tax bracket today

✔ You expect a lower tax rate in retirement

🤔 Which Is Right for You?

Ask yourself these questions:

✔️ 1. Are you in a high tax bracket today?

Traditional IRA may give you larger current tax savings.

✔️ 2. Do you expect higher taxes in the future?

Roth IRA could save you more over the long term.

✔️ 3. Are you young with many years of compounding ahead?

Roth’s tax-free growth can be powerful.

✔️ 4. Do you want flexibility and no RMDs?

Roth IRAs give you withdrawals without the IRS forcing distributions.

👉 You can also contribute to both Traditional and Roth IRAs if eligible — providing tax-diversification. (Warren - AI Financial Advisor)

📸 Example Financial Products for Retirement Investing (USA)

These platforms provide IRA accounts with tools to compare investments, tax implications, and returns — perfect for US investors planning long-term:

Vanguard IRA Accounts

Fidelity Retirement Accounts

Charles Schwab IRA Services

Betterment Roth IRA & Traditional IRA

👉 Actionable CTA:

🔹 Compare investment platforms to see expenses, tools, and user reviews

🔹 Check current IRA contribution limits and tax rates

⚠️ Risk Disclaimer

This article is for informational purposes only and does not constitute financial, tax, or investment advice. Tax laws change frequently, and individual circumstances vary. Consult a licensed financial advisor or tax professional before making retirement planning or investment decisions. Past performance is not indicative of future results. Investments involve risk, including loss of principal.

🏁 Conclusion

So, which IRA saves more on taxes?

📌 Roth IRAs are often better if you:

Expect higher taxes later,

Want tax-free retirement growth,

Prefer flexibility and no RMDs.

📌 Traditional IRAs are often better if you:

Want immediate tax deductions,

Are in a high tax bracket today,

Expect lower future taxes.

The “best” choice depends on your current tax situation, future expectations, and retirement goals. Many savers choose a blend of both to maximize tax efficiency year-by-year.

📚 Official Resources & Further Reading

🔗 IRS Retirement Plans Information — IRS.gov Explore IRS Individual Retirement Arrangements (IRAs)

🔗 Fidelity IRA Comparison — Fidelity.com Roth vs Traditional IRA Feature Breakdown

🔗 Britannica on Roth vs Traditional IRAs — Encyclopedia Britannica Roth vs Traditional IRA Explained

Author Bio:

Azka – Financial Enthusiast is passionate about empowering everyday investors with clear, actionable insights into retirement planning, tax strategy, and personal finance tools. Azka writes detailed guides to help Americans make smarter investment decisions and grow wealth with confidence.