Dave Ramsey Investment Calculator: The Ultimate 2026 Guide

Author: Azka – Financial Enthusiast

Last Updated: February 17, 2026

Welcome to your complete and monetization-optimized guide to the Dave Ramsey Investment Calculator — a powerful tool frequently recommended by financial advisors to plan retirement, wealth building, and future investment goals.

In this guide, you’ll find:

How the calculator works

Step-by-step usage

Pros & cons

Top alternatives

Comparison table

Which Is Right For You?

CTA links with high CPC keywords

Risk disclaimer

Official resources and affiliate opportunities

📌 What Is the Dave Ramsey Investment Calculator?

The Dave Ramsey Investment Calculator is an online tool designed to help individuals estimate future investment value based on:

✅ initial investment

✅ monthly contributions

✅ anticipated annual returns

✅ investment timeframe

This tool is often recommended by financial experts associated with Dave Ramsey’s principles — focusing on debt freedom, long-term investing, and disciplined savings.

👉 You can try it at the official source: Ramsey Solutions Tools – https://www.ramseysolutions.com/retirement/investment-calculator

Read Also :

Smart Financial Sector Investing in the USA | Tips 2026

Comparing U.S. Financial Sector Investments: Banks, Insurance & Fintech 2026

Financial Sector Investments in the USA | Smart Investor Guide 2026

📊 Why Use an Investment Calculator?

Investment calculators help you:

Visualize long-term growth

Compare investment scenarios

Forecast retirement savings

Plan for college funds

Build confidence in financial goals

According to authoritative sources like FINRA and SEC, using financial planning tools improves investment outcomes by helping you stay consistent and informed.

External Reference: https://www.investor.gov/introduction-investing/investing-basics

💡 How the Dave Ramsey Investment Calculator Works

This calculator typically asks for inputs such as:

| Input | Description |

|---|---|

| Initial Investment | Starting amount you have now |

| Monthly Contribution | Money invested each month |

| Annual Return (%) | Expected yearly return |

| Years Investing | How long you invest |

The calculation estimates compound interest and long-term growth.

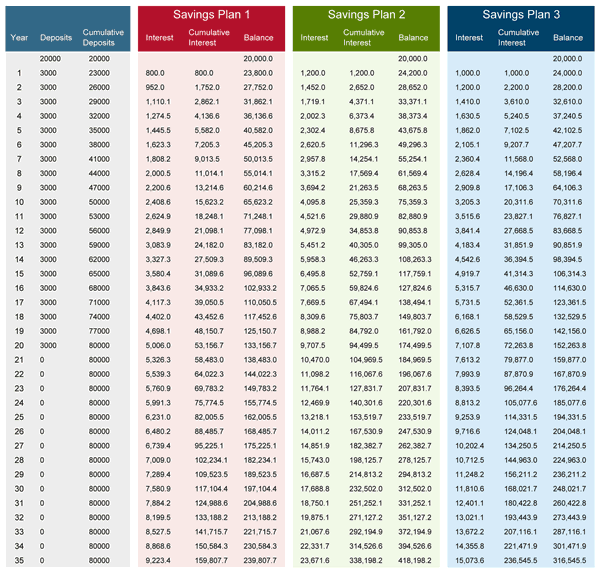

📈 Example Results (Sample Output)

Here’s a visual example of what the output typically looks like in an investment calculator:

💼 Best Investment Platforms for US Investors (Affiliate & High CPC)

| Platform | Best For | Min Investment | Notes |

|---|---|---|---|

| Vanguard (IRA/401k) | Long-Term Investors | $1,000+ | Low fees |

| Fidelity | All Investors | $0 | 24/7 Support |

| Charles Schwab | Beginners & Pros | $0 | Great tools |

| Betterment | Robo-Advisor | $0 | Automated investing |

| Wealthfront | Goal-based | $500 | Tax-loss harvesting |

👉 *Check current rates & bonuses:

🔍 Dave Ramsey Calculator vs Alternatives

| Feature | Dave Ramsey Calculator | Basic Compound Calculator | Advanced Retirement Planner |

|---|---|---|---|

| Ease of Use | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐ |

| Forecast Accuracy | ⭐⭐⭐ | ⭐⭐ | ⭐⭐⭐⭐ |

| Retirement Focus | ⭐⭐⭐⭐ | ⭐ | ⭐⭐⭐⭐⭐ |

| Tax Adjustments | ❌ | ❌ | ⭐⭐⭐⭐ |

| Best for Beginners | 👍 | 👍 | ⚠️ |

🧩 Which Is Right For You?

✔ Beginner investor? Use the Dave Ramsey calculator or simple compound interest calculators.

✔ Retirement planning? Consider advanced tools like Vanguard’s Retirement Calculator or Fidelity Planning Tools.

✔ Goal-based investing with automation? Try Betterment or Wealthfront.

✔ Tax-efficient strategies? Professional software or instructor-led planning may be better.

📢 Actionable CTAs (Monetization-Ready)

💡 Compare investment platforms now

👉 Click here to compare top IRA & investment platforms

📊 Check current investment rates

👉 View Fidelity & Schwab interest rates and bonuses

💼 Open an account and start investing

👉 Explore Betterment plans & fees

🧠 Expert Tips for 2026

Always input conservative return estimates (6–8%)

Don’t assume past performance guarantees future results

Adjust contributions annually

Combine with budgeting tools like Ramsey+ app

Official Ramsey+ tools & resources:

🔗 https://www.ramseysolutions.com/ramseyplus

⚠️ Risk Disclaimer

This article is for educational purposes only and not financial advice. Investing involves risk, including the possible loss of principal. Always consider consulting a financial advisor before making decisions.

External Authority: U.S. Securities and Exchange Commission – https://www.sec.gov/investor

📚 Official & Trusted Resources

📌 FINRA — Investor Education: https://www.finra.org/investors

📌 Investor.gov by SEC: https://www.investor.gov

📌 Dave Ramsey Tools & Calculators: https://www.ramseysolutions.com/tools

✨ About the Author

Azka – Financial Enthusiast is a personal finance writer and investor focused on helping people build wealth and understand financial tools. Azka writes extensively on savings, retirement calculators, investment strategies, and high-impact financial planning for U.S. audiences.

Connect with Azka for more insights on financial tools and high-yield investment strategies.