The Ultimate Guide to Stock Screeners for USA Market Beginners (2026)

Investing in the U.S. stock market can be intimidating for beginners. One of the smartest steps you can take is to use a stock screener — a tool that helps you filter stocks quickly based on criteria like valuation, growth, price performance, and more. Whether you’re aiming for long‑term investing or active trading, understanding stock screeners is essential for making smarter decisions in the USA markets (NYSE, NASDAQ, AMEX).

This article covers everything you need:

✔ What stock screeners are

✔ Why beginners should use them

✔ Top screeners for USA beginners

✔ Feature comparison table

✔ “Which Is Right for You?” section

✔ Risk disclaimer

✔ Actionable CTAs: Compare investment platforms / Check current rates

✔ Official links to browse tools and data

What Is a Stock Screener?

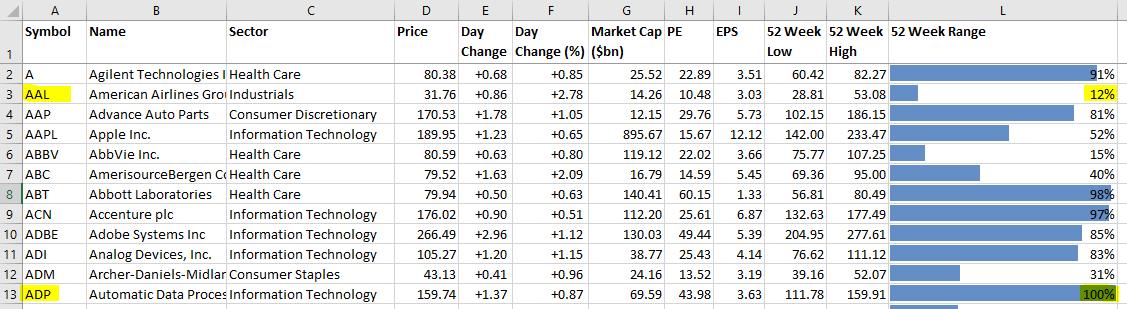

A stock screener is an online tool that filters publicly traded companies based on selected financial, technical, or fundamental criteria. Instead of manually searching every ticker, you define rules — like market cap above $2B or P/E ratio below 20 — and the screener returns stocks that meet them.

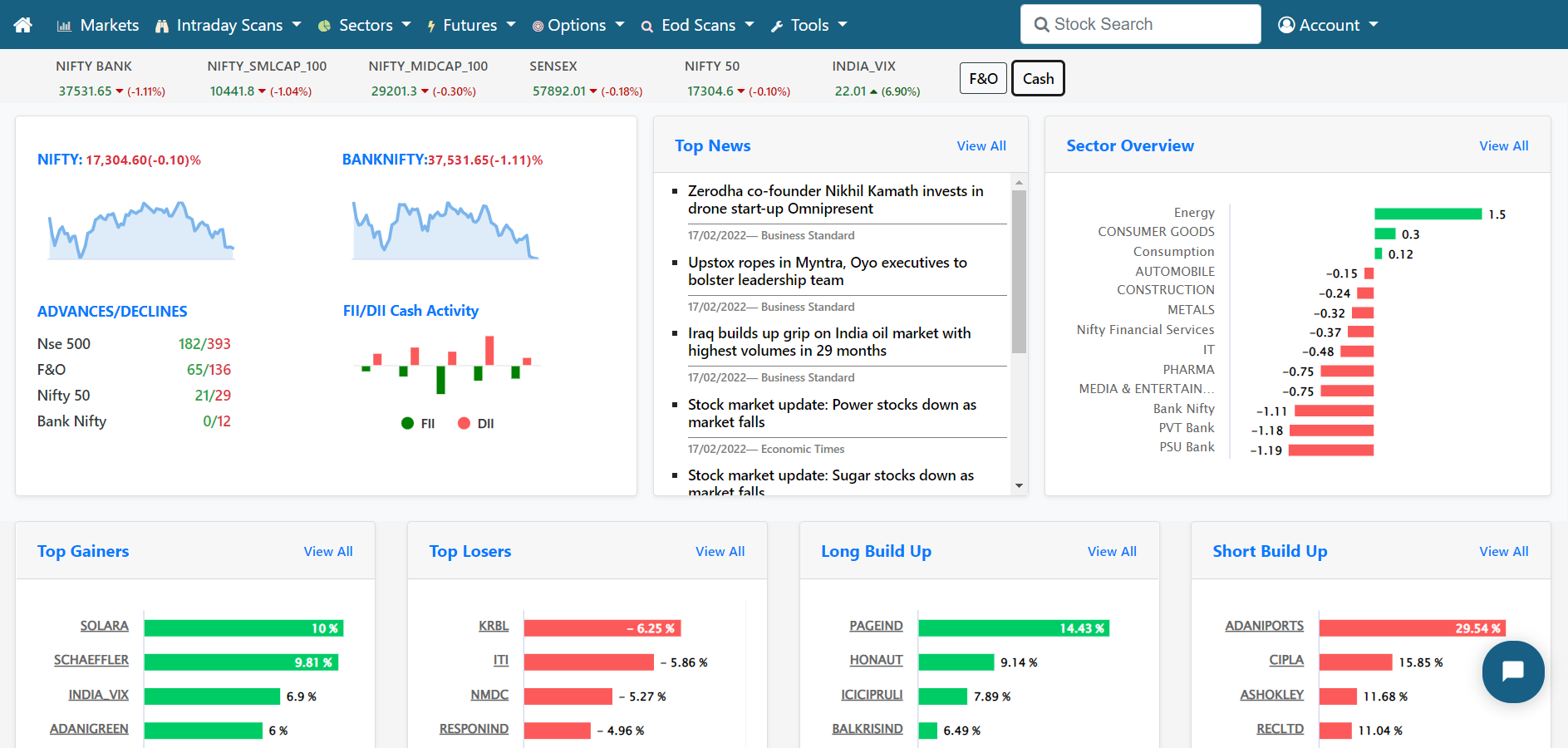

For U.S. stocks, main exchanges covered are:

NYSE (New York Stock Exchange)

NASDAQ (Nasdaq Stock Market)

AMEX (NYSE American)

These tools can also filter ETFs, mutual funds, and sometimes options or crypto derivatives. (Benzinga)

Why Beginners Should Use a Stock Screener

Stock screeners help beginner investors:

✅ Avoid analysis paralysis — by narrowing choices

✅ Compare companies quickly

✅ Learn key fundamentals (P/E, ROE, dividend yield)

✅ Spot growth or value opportunities

Screeners also reduce emotional decisions, helping you focus on data‑driven investing, which aligns with principles from the U.S. Securities and Exchange Commission (SEC) educational materials on researching stocks (see SEC Investor.gov). https://www.investor.gov/introduction‑investing/investing‑basics/how‑investors‑research‑and‑compare‑investments

Top Stock Screeners for USA Market Beginners

Below are the most popular and effective stock screeners beginners can start with today.

| Tool | Price | Best For | Mobile App | Real‑Time Data |

|---|---|---|---|---|

| Finviz | Free / $39.50/mo | Beginner & Visual | No | Elite version |

| Yahoo Finance | Free | Beginners / News | Yes | Yes |

| TradingView | Free / Paid | Technical analysis + screens | Yes | Yes |

| Stock Rover | Free / $27.99/mo | Fundamentals & scoring | No | Yes |

| Benzinga Pro | $37–$197/mo | Real‑time scanning | Yes (iOS) | Streaming |

| TrendSpider | $82–$183/mo | Automation & patterns | Yes | Yes |

Comparison summary from Benzinga and other independent research sources. (Benzinga)

Best for Absolute Beginners

Yahoo Finance Stock Screener (Free)

Simple layout perfect for first‑time investors

No cost to use basic filters

Integrates with U.S. market news and portfolios

Works on web and mobile

👉 https://finance.yahoo.com/screener/ (Skyriss)

Why it’s great: Beginners can filter by market cap, sector, price, volume, dividend yield, and see results in real time.

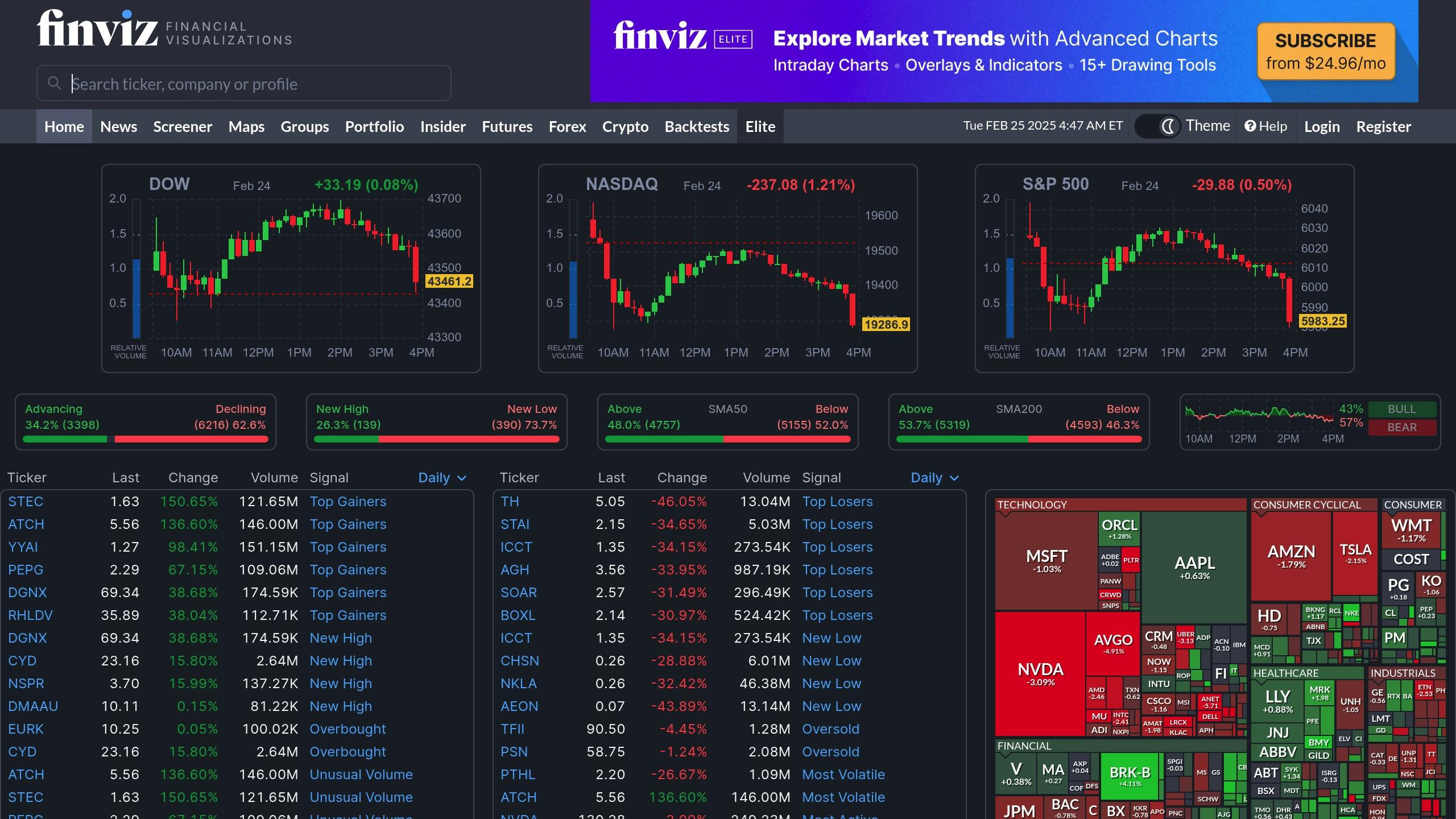

Best All‑Around for U.S. Stocks

Finviz

Very visual with heat maps and charts

Hundreds of criteria to filter U.S. equities

Free version available — Elite gives real‑time, export, alerts

👉 https://finviz.com/screener.ashx (Skyriss)

Finviz is one of the most popular screeners among both beginners and seasoned investors.

Best for Technical & Charting

TradingView

Combines screener with advanced charting

168+ criteria (fundamental + technical)

Works globally but strong U.S. market coverage

👉 https://www.tradingview.com/markets/stocks‑usa/screener/ (InvestorStack)

Great for beginners who want to learn market trends

Best for Fundamentals

Stock Rover

Deep fundamental filters and scoring

Track metrics like ROE, earnings growth, fair value

👉 https://www.stockrover.com (Benzinga)

Excellent for “value‑driven” beginners focusing on long‑term investing.

How to Use a Screener: Step‑by‑Step for Beginners

Define Your Goals

Long vs. short term

Growth vs. dividend investing

Select Key Metrics

Market Cap: large caps often safer for beginners

P/E ratio: profitability valuation

PEG ratio: growth adjusted valuation

Run & Filter

Set your criteria and run the screener

Sort results by volume or sector

Review & Research

Study company fundamentals and news

Use SEC EDGAR for official filings https://www.sec.gov/edgar.shtml

Which Is Right for You?

🤔 Complete Beginner + Zero Cost:

Start with Yahoo Finance or Finviz Free.

📈 Explore Charts + TAs:

Choose TradingView to combine screening and technical insights.

📊 Fundamentals + Portfolio Scoring:

Go for Stock Rover if you're serious about deep research.

💼 Real‑Time Market Prospects:

Consider Benzinga Pro or TrendSpider once you’re more advanced.

Quick Tips for USA Market Beginners

📌 Always cross‑check screener results with official financial reports — available on SEC EDGAR. https://www.sec.gov/edgar.shtml

📌 Avoid relying on one single metric — diversification is key.

📌 A screener isn’t a recommendation — it’s a starting point.

Risk Disclaimer

Important: Stock screeners provide data and insights, not financial advice. Investing in the stock market involves risk, including loss of principal. Always conduct your own due diligence and consider consulting a licensed financial professional before investing. Past performance is not indicative of future results.

Calls to Action

🔍 Compare investment platforms — Choose the best broker and tools for your investing style.

📈 Check current market data — Get live access to U.S. stock prices.

Author Bio

Azka – Financial Enthusiast

Azka is a passionate financial writer focused on helping beginners navigate investing tools and strategies in the U.S. markets. With a deep interest in data‑driven decision‑making and financial education, Azka publishes beginner‑friendly insights and comparisons to empower smarter investing.