The Complete Guide to Tax Implications of U.S. Stock Investments

Table of Contents

Introduction

How U.S. Stock Investments Are Taxed

Key Tax Forms You’ll Encounter

Tax Rates on Capital Gains & Dividends

Special Considerations for Non‑U.S. Investors

Tax‑Advantaged Accounts in the U.S.

International Tax Treaties & Reporting Rules

Comparison Table: Tax Types & Rates

Which Is Right for You?

Practical Tax Planning Tips

Risk Disclaimer

CTA: Compare Investment Platforms / Check Current Rates

Author Bio

1. Introduction

Investing in U.S. stocks can be one of the most effective ways to build long‑term wealth. But understanding taxes is critical to keeping more of your gains. Whether you’re a U.S. resident or an international investor, the tax implications vary significantly — and missing key rules can lead to unexpected bills or even penalties.

This comprehensive guide explains how U.S. stock investments are taxed, links directly to official government sources, and helps you make smarter decisions while minimizing tax liabilities.

2. How U.S. Stock Investments Are Taxed

When you invest in U.S. stocks, your tax exposure normally arises in three primary areas:

Capital Gains Tax — tax on profit when you sell a stock

Dividend Income Tax — tax on dividends you receive

Withholding Tax (for non‑U.S. investors) – automatic tax deducted on U.S. source income

Capital Gains

When you sell a stock for more than you paid, you realize a capital gain. The IRS treats this gain as taxable income. Depending on how long you held the investment, it can be:

Short‑Term Capital Gains (held 1 year or less) — taxed at ordinary income tax rates

Long‑Term Capital Gains (held over 1 year) — taxed at preferential rates

For official IRS guidance, see IRS Topic No. 409 — Capital Gains and Losses: https://www.irs.gov/taxtopics/tc409

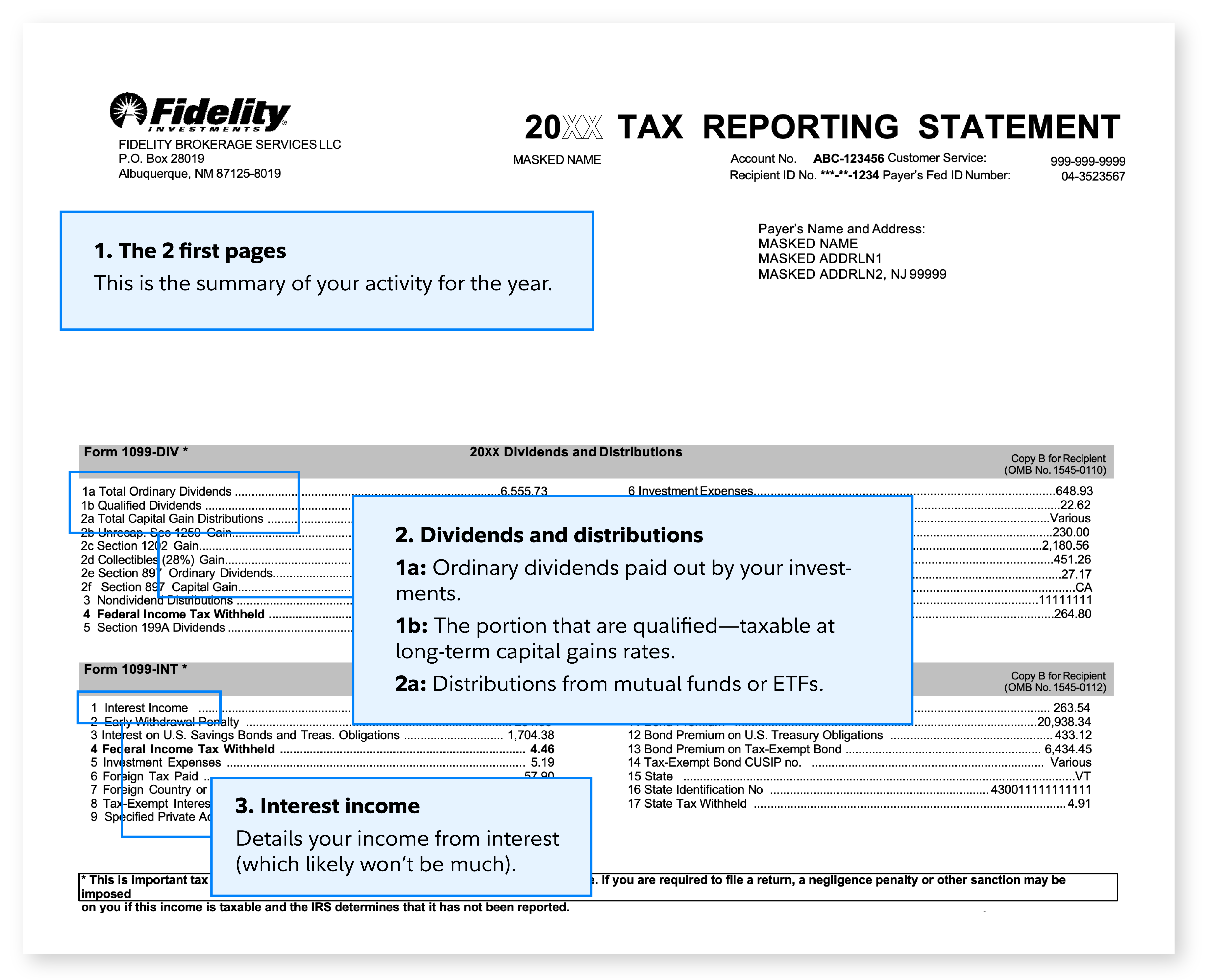

3. Key Tax Forms You’ll Encounter

Here are the key tax forms associated with stock investing:

Form 1099‑B – reports proceeds from stock sales

Form 1099‑DIV – reports dividends and distributions

Form W‑8BEN – for non‑U.S. investors to claim reduced withholding per tax treaties

Official forms can be accessed at the IRS Forms & Publications page:

https://www.irs.gov/forms‑instructions

4. Tax Rates on Capital Gains & Dividends

Understanding tax rates is essential:

For U.S. Residents

| Income Type | Tax Rate (2025) | Notes |

|---|---|---|

| Short‑Term Capital Gains | Ordinary tax rates (10–37%) | Same as regular income tax |

| Long‑Term Capital Gains | 0%, 15%, or 20% | Based on taxable income |

| Qualified Dividends | 0%, 15%, or 20% | Must meet holding period rules |

| Non‑Qualified Dividends | Ordinary rates | Taxed as regular income |

IRS Reference (Capital Gains & Qualified Dividends):

https://www.irs.gov/taxtopics/tc409

5. Special Considerations for Non‑U.S. Investors

Non‑U.S. shareholders face different rules:

Withholding Tax — typically 30% on U.S. dividends

May be reduced through tax treaties

No U.S. capital gains tax on stocks if no U.S. business presence

Must file Form W‑8BEN with brokers

See IRS rules for nonresident aliens here:

https://www.irs.gov/individuals/international‑taxpayers/nonresident‑aliens

6. Tax‑Advantaged Accounts in the U.S.

Investing through special U.S. accounts may defer or eliminate tax:

| Account Type | Tax Treatment | Available to Non‑U.S. Investors? |

|---|---|---|

| 401(k) | Tax‑deferred | No |

| Traditional IRA | Tax‑deferred | Depends on residency |

| Roth IRA | Tax‑free on gains | Depends on residency |

| 529 College Plan | Tax‑free for qualified expenses | Generally yes |

Learn more at IRS Publication 590:

https://www.irs.gov/publications/p590a

7. International Tax Treaties & Reporting Rules

The U.S. has treaties with numerous countries that may reduce withholding tax on dividends. To benefit:

Submit Form W‑8BEN

Provide your taxpayer ID (if required)

Check specific treaty provisions

For the latest treaties and rates, consult the Tax Treaty Tables:

https://www.irs.gov/individuals/international‑taxpayers/tax‑treaty‑tables

8. Comparison Table: Tax Types & Rates

| Tax Feature | U.S. Resident | Non‑U.S. Investor |

|---|---|---|

| Capital Gains Tax | Yes (short & long) | Often No* |

| Dividend Tax | Qualified/Non‑Qualified | Withholding Tax |

| Reporting Required | Yes | Yes |

| Withholding Relief via Treaty | N/A | Yes (with Form W‑8BEN) |

| Tax Forms | 1099 series | W‑8BEN + 1040NR (if filing) |

* Exceptions may apply if agent/broker handles differently or if investor has U.S. PE.

9. Which Is Right for You?

If You’re a U.S. Resident:

✔ Focus on holding stocks long‑term for lower tax rates.

✔ Use tax‑advantaged accounts where possible (IRA, 401(k)).

✔ Track cost basis carefully to calculate gains correctly.

If You’re a Non‑U.S. Investor:

✔ Submit Form W‑8BEN to reduce withholding.

✔ Understand your own country’s tax system — gains may be taxed locally.

✔ Don’t assume capital gains taxes are automatic; in many cases they are not — but always confirm with a tax advisor.

10. Practical Tax Planning Tips

✔ Track holding periods — to qualify for long‑term treatment.

✔ Harvest tax losses — offset gains by realizing losses.

✔ Consult a CPA or tax attorney knowledgeable in U.S. and international tax.

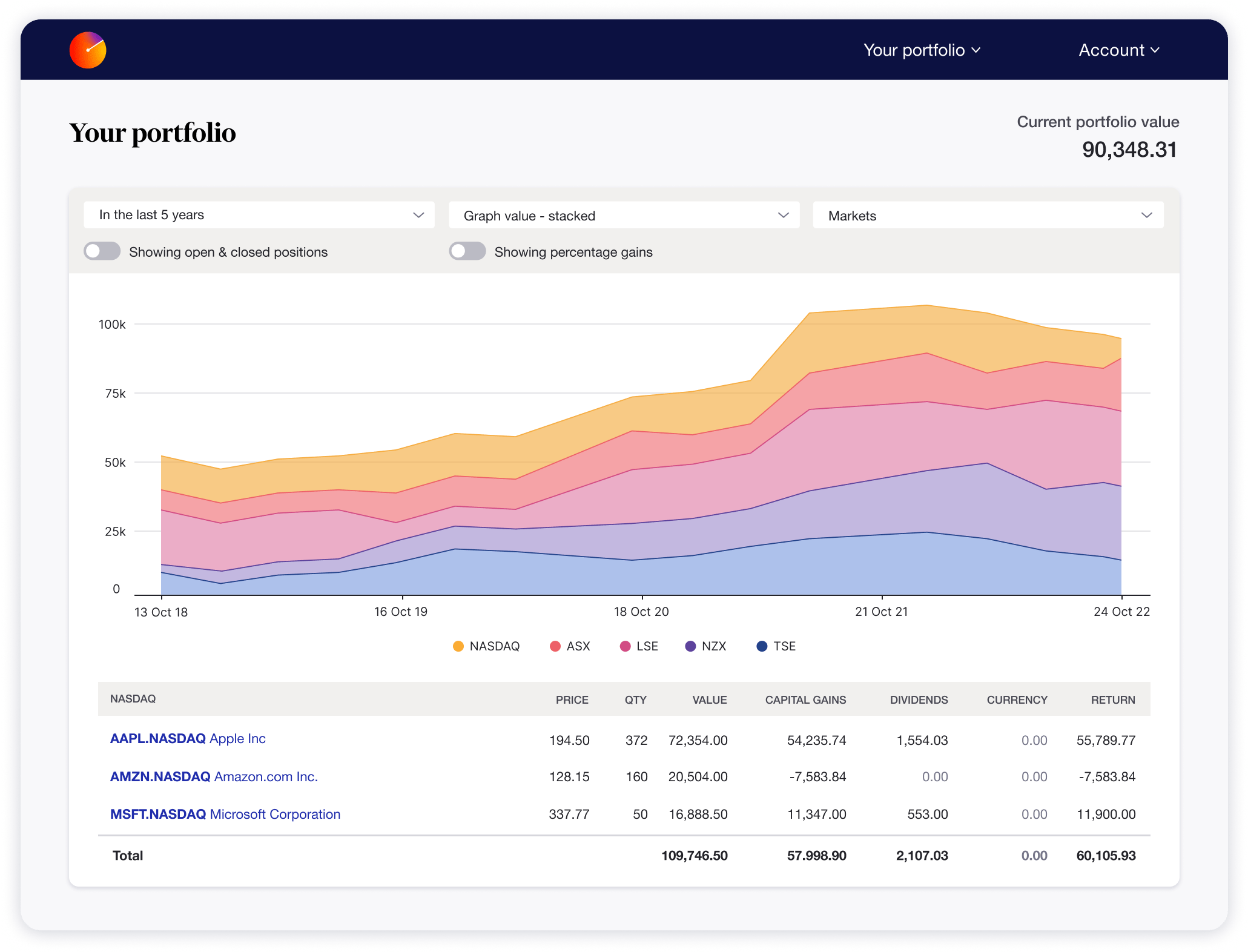

✔ Use reliable investment platforms that provide accurate tax documentation.

11. Risk Disclaimer

Disclaimer: This article is educational only and not financial or tax advice. Tax laws change frequently. Your personal tax situation may vary. Consult a qualified tax professional or certified public accountant before making investment decisions or interpreting your tax obligations.

12. Call‑to‑Action

👉 Compare Investment Platforms — find one that offers robust tax reporting and supports international investors.

👉 Check Current Rates — dividend withholding and capital gains tax brackets change; verify with official IRS publications or your tax professional.

13. About the Author

Azka – Financial Enthusiast

Azka is a finance content specialist passionate about helping investors understand the complexities of international markets and tax systems. With a focus on clarity and accuracy, Azka bridges finance concepts and real‑world decision‑making. Connect with more of Azka’s insights on financial literacy, investing, and global tax trends.