The Ultimate Guide to Robo‑Advisors for Investing in U.S. Stocks (2026)

Learn how automated platforms can help you build wealth, compare top services, understand risks, and find the right match for your financial goals.

Investing in U.S. stocks doesn’t have to be complicated, time‑consuming, or expensive. Thanks to robo‑advisors — automated investment platforms that manage portfolios using algorithms — investors of all levels can access diversified U.S. stock exposure with minimal effort. Whether you’re new to investing or seeking a set‑and‑forget strategy, robo‑advisors are rapidly becoming a go‑to choice for Americans. (Creditavel)

Below, we’ll explain what robo‑advisors are, how they work, compare top platforms, discuss their pros and cons, and help you decide which one is right for you.

📈 What is a Robo‑Advisor?

A robo‑advisor is an online financial service that uses computer algorithms to build and manage investment portfolios for you. Instead of selecting individual stocks or funds manually, you input your goals and risk tolerance, and the platform designs and rebalances a diversified portfolio — often centered around U.S. stock ETFs and index funds. (Creditavel)

Unlike traditional human advisors — who may cost 1%–2% of your assets annually — robo‑advisors typically charge 0.15%–0.50% per year and automate tasks like diversification and rebalancing, making them highly cost‑effective. (Tefox Daily)

Official U.S. regulatory guidance on investment advisors, including automated platforms, is available via the U.S. Securities and Exchange Commission (SEC):

👉 https://www.investor.gov/introduction‑investing/investing‑basics/how‑investment‑advisors‑work

📊 Why Robo‑Advisors Are Popular for U.S. Stock Investing

Benefits include:

✔️ Low fees and accessibility — Many require little or no minimum investment, and low annual fees compared to human advisors. (Creditavel)

✔️ Automated rebalancing and tax‑loss harvesting — These tools help maintain your target allocation and reduce tax liability. (Experian)

✔️ Diversification — Instead of picking individual names, you get exposure to broad U.S. stock market indices via ETFs.

(Creditavel)

✔️ Convenience — No in‑person meetings; everything is managed via app or web.

Limitations to consider:

⚠️ Limited personalization — Most robo‑advisors use algorithmic models rather than customized strategies. (ETNA)

⚠️ No emotional guidance — Algorithms can’t comfort you in volatile markets the way a human advisor might. (Loanch)

⚠️ Restricted investment options — Many platforms focus on ETFs and index funds and may not offer individual stock trading. (Finance Dispatch)

📋 Top Robo‑Advisor Platforms for U.S. Stock Investing

Here’s a snapshot of leading automated investment platforms in 2026.

| Platform | Annual Fee | Minimum Investment | Best For |

|---|---|---|---|

| Betterment | 0.25%–0.40% | $0 | Beginners & goal‑based investors; tax‑loss harvesting |

| Wealthfront | 0.25% | $500 | Tech‑savvy investors; financial planning tools |

| Fidelity Go | $0–0.35% | $10 | Fidelity customers; beginners |

| Vanguard Digital Advisor | ~0.15% | $100 | Cost‑conscious & long‑term investors |

| Schwab Intelligent Portfolios | $0 | $0 | Investors seeking low cost with Schwab services |

| M1 Finance | Variable | $100 | Investors who want automation + customization |

Sources for these platforms and features: (Future Fortune Path)

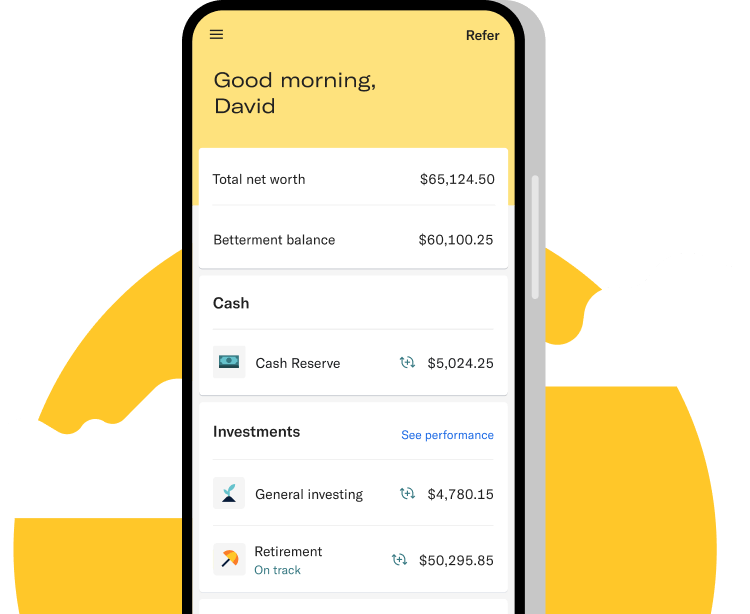

🖼️ Example Platforms & What They Look Like

Below are example images showing product interfaces from popular robo‑advisor apps (for illustrative purposes in the U.S. market):

(Actual interface appearance may vary.)

📌 Which Is Right for You?

Best for Beginners

Betterment and Fidelity Go require minimal investment and offer gentle onboarding. (Future Fortune Path)

Best for Low Costs

Vanguard Digital Advisor and Schwab Intelligent Portfolios stand out with very low or no advisory fees. (Future Fortune Path)

Best for Planning Tools

Wealthfront offers advanced planning tools and tax management features. (Future Fortune Path)

Best for Flexibility

M1 Finance blends automation with customizable “pies” allowing control over specific allocations. (Future Fortune Path)

Checklist to decide:

✔ Do you want lowest fees or highest automation?

✔ Do you prefer hands‑off investing or some control?

✔ Do you need access to tax‑loss harvesting or financial planning tools?

⚠️ Risk Disclaimer

Investing always carries risk.

Robo‑advisors do not guarantee returns or protection against losses. The value of your portfolio can go down as well as up, especially in volatile markets. U.S. stocks, while historically strong in long‑term growth, can experience sharp downturns. Past performance is not indicative of future results. Always consider your risk tolerance, investment horizon, and financial goals before investing. For additional investor protection information, see the Securities Investor Protection Corporation (SIPC): https://www.sipc.org/

📍 Official & Authoritative Resources

U.S. Securities and Exchange Commission (SEC) – Investment Advisor Info: https://www.investor.gov/

FINRA – Robo‑Advisor Tools & Tips: https://www.finra.org/investors

SIPC – Investor Protection: https://www.sipc.org/

These resources help you understand legal protections and what to watch for when investing through automated platforms.

📣 Call to Action

📌 Ready to take the next step?

👉 Compare investment platforms — Explore user reviews, fees, and features side‑by‑side before committing.

👉 Check current rates — Advisory fees and minimums can change; always verify with the official platform site before investing.

✍️ About the Author

Azka – Financial Enthusiast

Azka is a passionate financial writer focused on helping everyday investors navigate the world of automated investing, stocks, and wealth‑building strategies. With a background in finance education and a deep interest in fintech innovation, Azka delivers clear, practical guidance tailored to both new and experienced investors.